estate tax changes build back better

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of Representatives.

Senate Democrats Reckless Gamble On Build Back Better The Atlantic

5376 would revise the estate and gift tax and treatment of trusts.

. While the plan is still in negotiations and changes to the legislation are likely many of the. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law.

Surtax of 5 on the modified adjusted gross income of a trust or estate above 200000 Additional 3 surtax on the modified adjusted gross. Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the previously scheduled sunset date of December 31 2025. The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate.

President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. Starting in 2022 Build Back Better makes a high income taxpayer treat the S corporation or active real estate income as net investment income. These proposals are currently under consideration by the U.

The revised version of the bill is silent regarding grantor trusts. The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031. The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust which would have virtually eliminated the use of grantor trusts as an estate planning tool.

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. Notable aspects of the Biden framework for the Build Back Better Act that will affect estate planning include. 2022 Updates to Estate and Gift Taxes.

The House Ways and Means Committee recently released a draft of the tax changes proposed as part of the budget reconciliation bill to implement President Bidens social and. For more on the nontax provisions of the bill see House Passes Build Back. 115-97 increase the limits on certain discounts of value for.

Lowering the gift and estate tax exemptions seems a lock. The modified version of the bill includes a substantial number of changes to the tax-related provisions of the bill as approved by the House Budget Committee in September 2021. It would eliminate the temporary increase in exemptions enacted in the Tax Cuts and Jobs Act TCJA.

None of the major provisions that would have affected estate planning were included in the House version. 5376 the Build Back Better Act. Ad See How Our Private Bank Team Can Help Educate You and Your Family About Trusts.

This new surtax would be imposed on non-corporate taxpayers such as individuals estates and trusts specifically including all undistributed income from estates and trusts in excess of 20000000. The House Rules Committee earlier today released a modified version of HR. Build Back Better changes this however.

Estate gift and GST tax. December 3 2021. November 19 2021.

Build Back Better Act and What the Changes to Gift and Estate Taxes Could Mean for Your Family Business. The Build Back Better Act includes a 5 surtax imposed on MAGI that have in excess of 10 million as well as an additional 3 surtax if the MAGI exceed 25 million. First the current USD117-million estate and gift tax exclusion was provided under a temporary clause of the Tax Cut and Jobs Act of 2017 and will be halved on 1 January 2026 even without any act of congress through the sunset provisions that remain in place.

That treatment potentially triggers the 38 net investment income tax on the S corporation distributive share or the active real estate investment income. The House of Representatives on Friday morning passed HR. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation.

Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Gift and Estate Taxes Proposed Under the Build Back Better Act.

In its then-current form the legislation would have had drastic impacts on transfer taxes grantor trust rules and income taxes. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. Latest Update on the Build Back Better Act for Estate Planners Tax planning techniques havent appeared in the most recent versions and dont appear to.

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the. The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build Back Better Act. 5376 the Build Back Better Act by a vote of 220213.

This preliminary analysis is still available here. Heres what you need to know. The bill encompasses a wide range of budget and spending provisions and has been the focus of protracted negotiations for the past several weeks.

November 5 2021. While the Build Back Better Act provides a temporary reprieve for those with assets. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction.

Build Back Better Ex Joe Manchin Aides Lobbied His Office Congress

Joe Biden Has Endorsed The Green New Deal In All But Name Julian Brave Noisecat The Guardian

A New Poll Finds Major Warning Signs For Biden And Fellow Democrats Npr

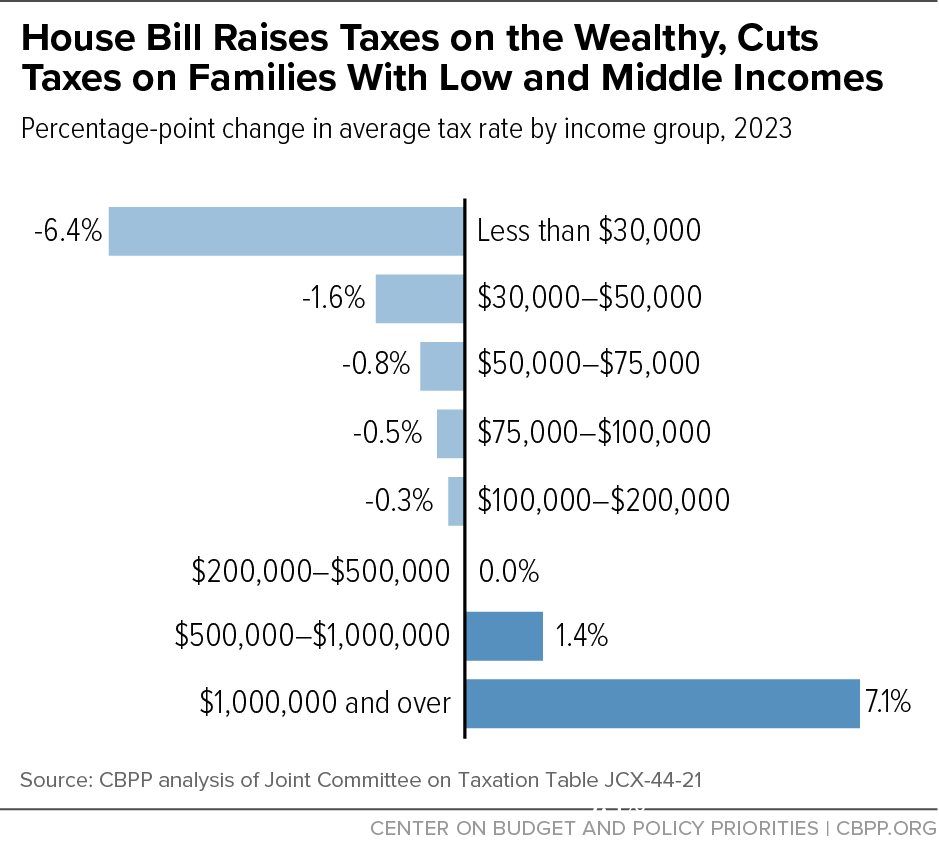

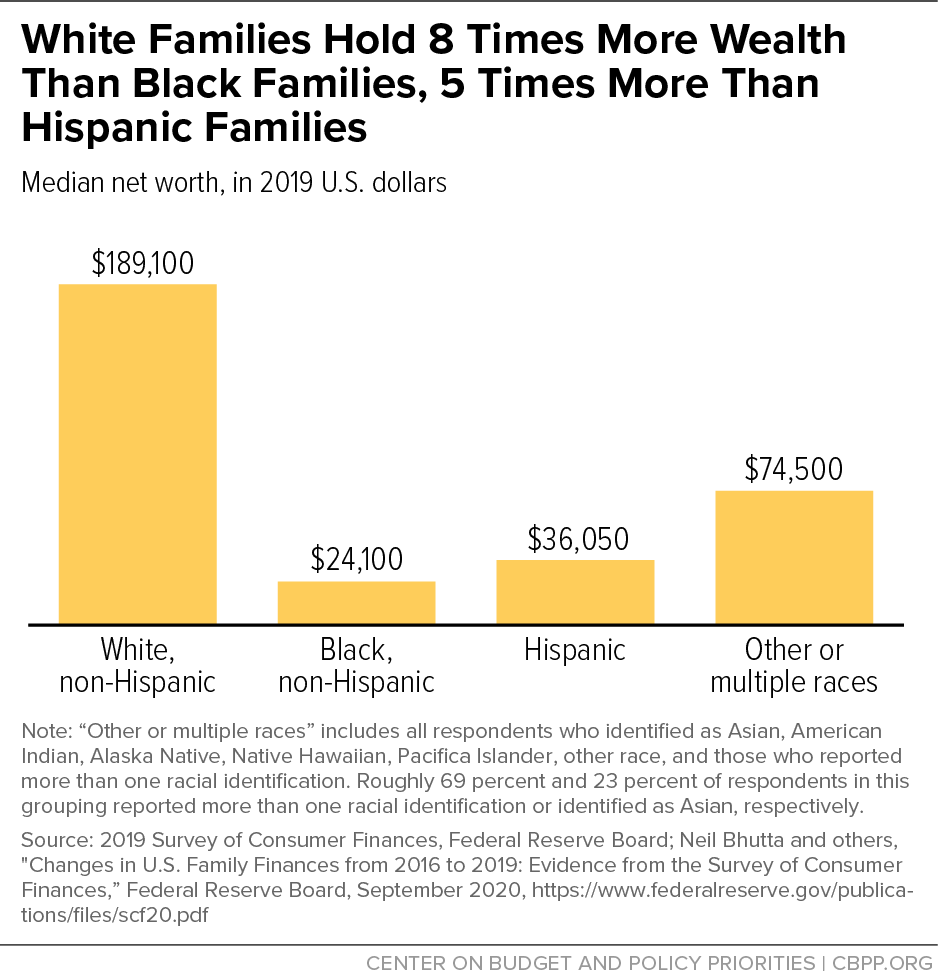

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Build Back Better May Be Dead But These Key Portions Will Pass Sen Kaine Says

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Opinion It S Time To Entertain The Possibility That The Build Back Better Bill Won T Pass The Washington Post

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act

Biden S Big Social Spending Bill Probably Will Pass Senate This Month Without Many Cuts To It Analysts Say Marketwatch

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

Stock Market Basics 3 Simple Long Term Stock Investment Strategies Stock Market For Beginners Finance Investing Best Way To Invest

/media/img/posts/2022/02/BBB_figure_5/original.png)

Biden S Biggest Idea On Climate Change Is Remarkably Cheap The Atlantic

The Great Reset Conspiracy Flourishes Amid Continued Pandemic Anti Defamation League

Editorial Joe Manchin Killed Build Back Better He Just Offered Biden A Way To Resurrect It

Biden S Build Back Better Agenda Stalls In The Senate Npr

Biden To Ceos To Promote His Stalled Build Back Better Bill

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities